Laurence Escalante, the billionaire founder of the social gaming behemoth Virtual Gaming Worlds, is at the center of a new storm of investor curiosity and concern with the launch of his latest venture, Kickr.

The new platform, a social sportsbook and sweepstakes casino, bears a remarkable resemblance to VGW’s own successful model, prompting industry observers and VGW shareholders to question the strategy behind what appears to be the creation of a direct competitor.

VGW has propelled Escalante’s fortune to incredible heights through its popular online social casinos like Chumba Casino and LuckyLand Slots. The company operates on a unique and highly profitable sweepstakes model, where users can play casino-style games for free with the chance to win real money prizes. This model has allowed VGW to navigate complex gaming regulations, particularly in the lucrative US market.

Now, Escalante has launched Kickr, a platform that also operates in the social gaming and sweepstakes casino space. While VGW is not the parent company of Kickr—it is owned by Escalante’s private family office, Lance East Office.

This has not gone unnoticed by VGW’s minority shareholders, who are reportedly frustrated and concerned about a potential conflict of interest.

The timing of Kickr’s launch is particularly noteworthy, as it comes while Escalante is attempting to take VGW private by buying out the remaining 30% of the company he doesn’t already own.

Shareholders are now reportedly questioning whether the offer undervalues VGW, especially if Escalante’s attention and resources are divided. The concern is that the founder’s new venture could potentially siphon off value and growth from the very company he is trying to acquire fully.

In a statement, VGW has sought to quell the concerns, asserting that Kickr is a “completely separate” business that has “no impact on VGW or its operations,” and that VGW “does not view it as a competitor,” according to Financial Review.

However, this has done little to silence the questions from the investment community. “It’s a bold move, and a puzzling one,” said one industry analyst who wished to remain anonymous according to Financial Review. “You have a hugely successful company in VGW, and then you launch something that looks like a direct competitor. The market is trying to understand the long-term strategy here. Is this a hedge? A new direction? Or is he simply competing with himself?”

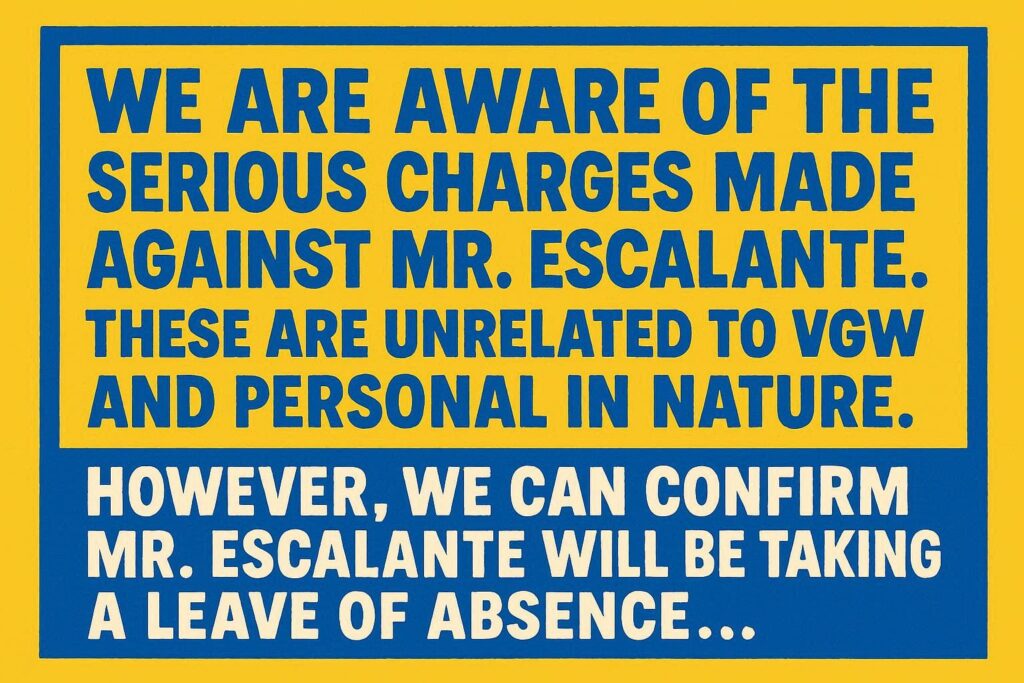

The situation is further complicated by a history of friction between Escalante and VGW’s shareholders. The billionaire has been noted for his candid and sometimes confrontational style, and this new venture has only added to the existing tensions.

As Escalante pushes forward with his bid to take VGW private, the launch of Kickr has added a new layer of complexity to the negotiations.

Shareholders will have to weigh the buyout offer against the potential impact of the founder’s new, and strikingly similar, venture.

For now, the industry watches with keen interest to see how this high-stakes game of competition and consolidation plays out.